The Banking, Financial Services and Insurance sector might have caught the social media fever relatively late but it managed to establish a strong online presence rather quickly. Major companies like ICICI, Axis Bank, HDFC, ING Vysya and many more such brands are highly active on social networking sites. But the social media activity of a business does not end at simply posting content on its channels. If you belong to the financial sector, then you are aware of the massive amount of online content available, related to the field. Analyzing this content can lead you to a gold mine of information that you can use to improve your marketing strategy. So here are seven ways in which financial companies can benefit from embracing social media monitoring –

1) Understand the market

Instead of trying to push your products and services on potential customers, wouldn’t it be easier if you understood the market first and then developed or modified your services? It would definitely boost customer response. And seeing as today’s market is ever changing, you need to constantly be on the alert for the latest trends and choices of customers so that you can base your products on these insights. For example, with the power of social media analytics, you can find out the share of voice for different product types – credit cards, debit cards, loans, salary accounts etc. You could get further details on the subjects being discussed under each product type. This can also help you to categorize your audience into different target groups and design customized offers/solutions for people based on their needs and preferences.

Source – A study done with a bank, the numbers are indicative.

2) Find Potential Customers

From the sea of online conversations, you can reach out to the people who are in need of or could benefit from your services! Aren’t chances of conversion of a prospect in need better than the cold mails you’ve been sending around over all these years?

A few keywords and a social media monitoring tool are all you need to discover these people and get in touch with them before your competitors. Based on their online discussions on social media or forums, you can understand who is more likely to respond to which offer and target them. Someone might be talking about buying a new house, some about a car, a student loan, or interest rates. Route these conversations to respective departments and you’ve got a list of hot leads!

The following examples just illustrate my point.

3) Identify Social Media Influencers

If you don’t already know, social media influencers are individuals who can affect the sentiments of their online audience. A good review from one such source can at times work better than expensive advertisements. On the flip side, one bad review from them and your company might have to say goodbye to a number of potential clients, who are a part of their audience.

Bradley Leimer is one of the top 20 banking influencers in social media. His post slighting Intuit’s (Offers online accounting software to small businesses) Mint.com could influence his audience’s opinion against the company.

Intuit’s Mint has always had those customer friendly emails…perhaps it’s your aggregation, not my account? pic.twitter.com/MsHB5kad2c

— Bradley Leimer (@leimer) May 9, 2014

4) Customer Feedback

Knowing what your customer thinks of your products and services is essential to survive in the market, that’s why you’ve been doing all those customer surveys, no? But one can no longer depend upon traditional marketing research.

And here’s an article that talks about, why experts are concerned about using it for actionable insights.

However, on the internet, customers are posting countless reviews and opinions about your products and services, without you even asking them. Social Media listening can easily help you understand sentiments surrounding your company. This feedback can be used improve existing and/or to design new products and offerings!

Let’s take Barclay’s for example. They launched a mobile banking app in 2012, through which customers could send money to others using only their phone number. Following real time social media analysis, Barclay’s made many changes to the app based on the online opinion and added features to suit the customer demands.

5) Customer Relationship Management

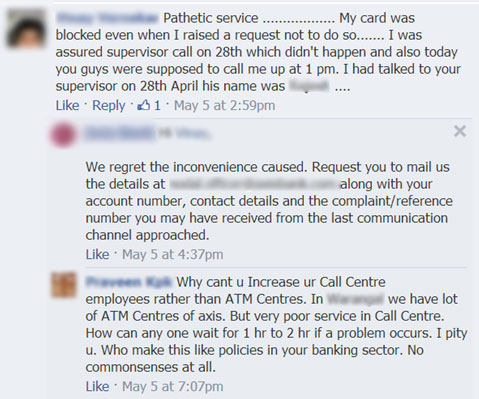

Similar to email or phone calls, social networking sites are fast becoming a new and convenient touch point for customers to reach out to companies to ask a question, give positive feedback or to complain. Well, chiefly to complain

And social media is the place where things go viral for good or for bad, not being there is not an option any more. In fact metrics like TAT (turnaround time) for online complaints is fast becoming the most important metric for Social CRM teams. Banking and Insurance companies especially tend to get numerous queries and complaints. Through consistent monitoring, you can identify these posts and give an immediate response to maintain good relations with them.

6) Analyze Your Competition

Isn’t your boss always asking you about what your competitor is doing?

Social media monitoring is useful not just to track online activity related to your brand it can also help you keep a tab on your competition. No seriously!

You can monitor conversations around their products, services, online sentiments, campaigns and much more.

As a small case in point, you can find out which of your competitors is most talked about. Then you can drill down into the sentiments surrounding them, what people are talking about – a new offer, interest rates, a new branch, so on and so forth. This can help you design strategies to match them and stay ahead of the curve.

7) Crisis Management

Warren Buffett famously said “It takes 20 years to build a reputation and five minutes to ruin it.”And in today’s digital world, where things can go viral in a matter of minutes, one dissatisfied customer or one little mistake on your part could potentially lead to a major PR crisis. Social Media Monitoring can help you identify such crisis at an early stage and you can take the necessary steps to contain it. For example, posts like the one below could easily dent the bank’s public image.

I’ve just listed a few examples where social media listening can be beneficial for the BFSI sector, to know more get in touch with us and we’d love to hear about your use case